12.11.2018

Progress Update: Reducing Long-Term Debt

Last week, Centrus took another step forward in its larger effort to reduce, restructure, and retire its long-term debt. Since these actions have unfolded in several phases, the Company is providing a more comprehensive update on what the effort has achieved.

Last week, Centrus took another step forward in its larger effort to reduce, restructure, and retire its long-term debt. Since these actions have unfolded in several phases, the Company is providing a more comprehensive update on what the effort has achieved.

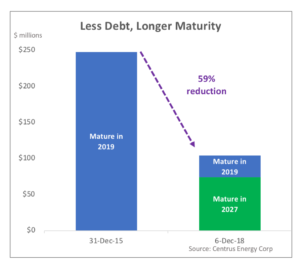

At the end of 2015, the Company’s debt stood at approximately $247.6 million; the 8 percent interest would amount to roughly $20 million per year. The notes were set to mature in 2019 (2019 Notes.)

Over the past three years, however, the Company has taken a series of steps to put itself in a much stronger position. In fact, Centrus has reduced the aggregate principal amount by nearly 60 percent, while extending the maturity for most of the remaining debt until 2027.

Below is a brief summary of actions taken to date:

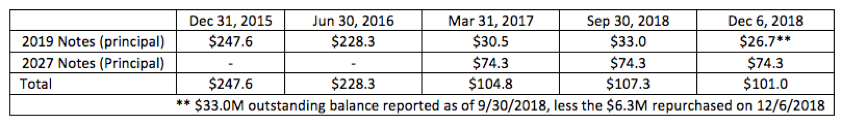

- In June 2016, Centrus was able to repurchase almost 10 percent of the 2019 Notes at a more than 60 percent discount from their principal amount. Centrus paid $9.8 million in cash for notes with an aggregate principal balance of $26.1 million and $0.5 million in accrued interest. Net of commissions and unamortized deferred financing costs, paying off this debt early produced a gain of $16.7 million.

- In February 2017, Centrus successfully completed an exchange offer for 87.4 percent of its outstanding 2019 Notes. The Company repurchased $204.9 million in outstanding notes in exchange for $27.6 million in cash, preferred stock with an aggregate liquidation preference of $104.6 million, and $74.3 million in new notes that are due in 2027.

- On December 6, 2018, Centrus completed a transaction to extinguish a portion of the remaining 2019 Notes. The Company paid $5.1 million in cash and 398,638 shares of common stock in exchange for 2019 Notes with a principal amount of $6.3 million. These notes would have continued to accumulate $0.4 million in additional interest through September 30, 2019.

Long Term Debt (in millions)

The foregoing is a summary and does not purport to be complete and is qualified in its entirety by the exchange agreements, indentures, and the descriptions of the exchange transactions, each as filed with and described in our annual, quarterly and periodic filings on Forms 10-K, 10-Q and 8-K.