10.01.2019

Centrus Repays $27.5 Million in Outstanding Notes

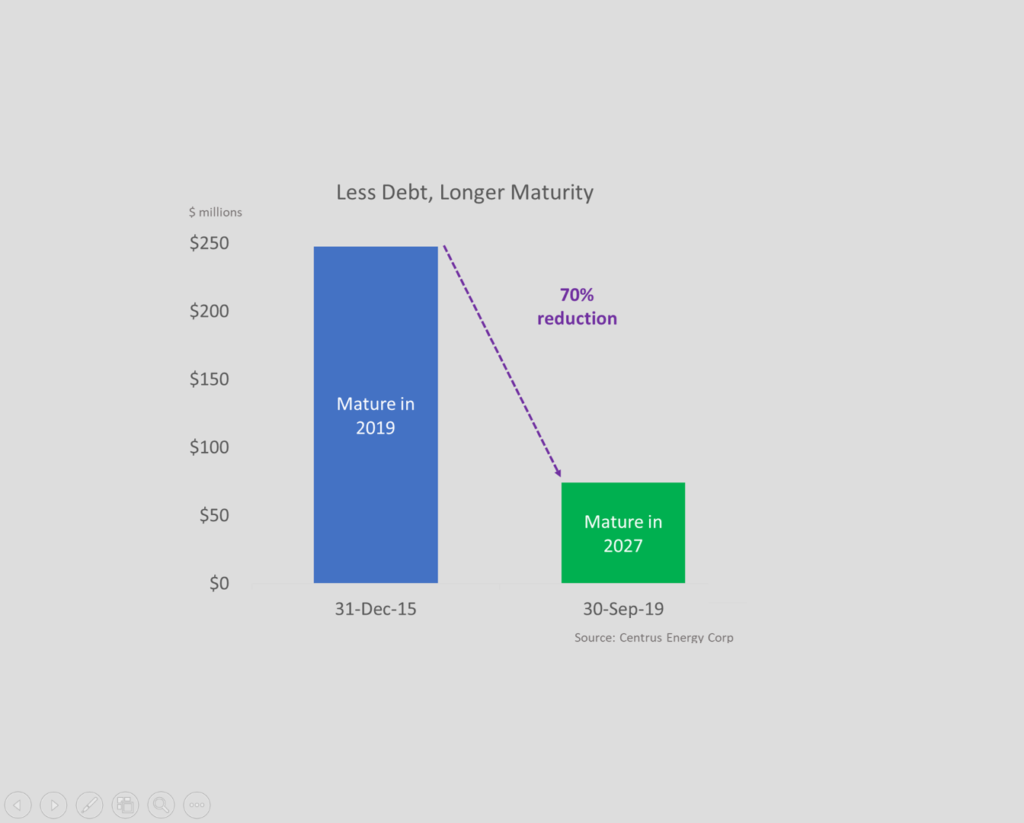

Debt reduced by 70 percent since 2015

BETHESDA, Md. – Centrus Energy Corp. (NYSE American: LEU) announced that it has fully repaid the $27.5 million in outstanding 8.0% PIK toggle notes that matured on September 30, 2019. This is the latest in a series of steps the company has taken to reduce its long-term debt. Following today’s payment, Centrus has cut the principal amount of its outstanding debt by 70 percent since the end of 2015.

“This is another important milestone in our long-term effort to strengthen our balance sheet and return the company to profitability by next year,” said Daniel B. Poneman, Centrus President and Chief Executive Officer. “Our improved financial health is helping us win new sales, sign new contracts, and expand long-term relationships with customers.”

Centrus ended 2015 with $247.6 million in long-term debt, with a maturity date of September 30, 2019. Since then the company has reduced its outstanding debt through several actions, including an exchange offer in 2017. These actions, combined with today’s payment, reduced the principal amount of the total outstanding debt to $74.3 million and extended the maturity date of the remaining debt to 2027.

A summary of previous actions to reduce, restructure, and retire Centrus’ debt is available on the Centrus website at: https://www.centrusenergy.com/news/progress-update-reducing-long-term-debt/

NOTE: The foregoing is a summary and does not purport to be complete and is qualified in its entirety by the exchange agreements, indentures, and the descriptions of the exchange transactions, each as filed with and described in our annual, quarterly and periodic filings on Forms 10-K, 10-Q and 8-K.

About Centrus Energy

Centrus is a trusted supplier of nuclear fuel and services for the nuclear power industry. Centrus provides value to its utility customers through the reliability and diversity of its supply sources – helping them meet the growing need for clean, affordable, carbon-free electricity. Since 1998, the Company has provided its utility customers with more than 1,750 reactor years of fuel, which is equivalent to 7 billion tons of coal.

With world-class technical capabilities, Centrus offers turnkey engineering and advanced manufacturing solutions to its customers. The Company is also advancing the next generation of centrifuge technologies so that America can restore its domestic uranium enrichment capability in the future. Find out more at www.centrusenergy.com.

###

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 – that is, statements related to future events. In this context, forward-looking statements may address our expected future business and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “will”, “should”, “could”, “would” or “may” and other words of similar meaning. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For Centrus Energy Corp., particular risks and uncertainties that could cause our actual future results to differ materially from those expressed in our forward-looking statements include: risks related to our significant long-term liabilities; potential strategic transactions, which could be difficult to implement, disrupt our business or change our business profile significantly; the competitive environment for our products and services; changes in the nuclear energy industry; the impact of financial market conditions on our business, liquidity, prospects, pension assets and insurance facilities; risks related to the identification of a material weakness in our internal controls over financial reporting; the risks of revenue and operating results fluctuating significantly from quarter to quarter, and in some cases, year to year; and other risks and uncertainties discussed in this and our other filings with the Securities and Exchange Commission, including under Part 1. Item1A – “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018 and quarterly reports on Form 10-Q.

CONTACT

Dan Leistikow (301) 564-3399